The headlines have been stark: a Chinese mining company moves an entire Peruvian town of 5,000 people five miles down the road to make way for its new mine.

It sounds like another story about an extractive corporation riding roughshod over local lives. But the reality is more complex. The decision to move the town was actually made before the Chinese company, Chinalco, took control. And, to the surprise of many, it may provide a template for successful overseas investment.

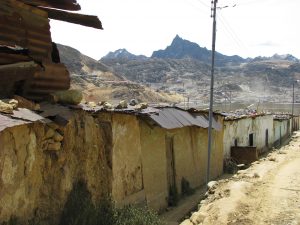

The town of Morococha is no stranger to mining companies. Situated in the province of Yauli, the birthplace of Peruvian mining just 90 miles to the east of the capital Lima, Morococha sprung up haphazardly in response to a local mining boom that began in the 1930s.

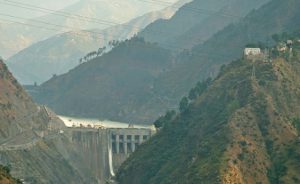

It lies under the shadow of Toromocho, a mountain with an estimated 5.7 million tonnes of copper – and the potential to become one of the most lucrative copper mines in the world.

Decades of poorly regulated mining around Morococha have left a dangerous legacy: a toxic, uncovered mine tailings deposit in the middle of the city. “Morococha is built on a toxic-waste site,” says Cynthia Sanborn, a scholar at Peruvian university El Pacifico, and expert on Chinese mining companies in Latin America. The town also lacks a proper sewage system and residents use communal latrines.

Moving an entire town

In 2006, the exploration firm PeruCopper applied to the Peruvian government for the right to turn Toromocho into an open-pit mine. The dire state of Morococha and its proximity to Toromocho meant that the relocation of the town was the only realistic option, according to Sylvia Matos of Peruvian mining consultancy Social Capital Group, hired by Peru Copper to carry out the project’s environmental and feasibility analysis in early 2006.

Yet moving a town of this size was something that had never been attempted before, and when PeruCopper opened the bidding for the concession, only one company showed an interest: Chinalco. “No other company was prepared to spend US$50 million on a social project before even seeing a cent of return,” explains Cynthia Sanborn. “No other companies have the deep pockets of the Chinese.”

After Chinalco bought the concession, it swiftly rehired Social Capital Group to handle the community relations aspects of the move. At every step Chinalco, a state-owned company making it first foray into Peru, has been careful to build and maintain a positive reputation within the local community, say supporters. Production at the mine is expected to start towards the end of this year.

Bad legacy of Shougang

Chinalco’s approach is striking for its contrast with the other main Chinese company in the region, Shougang. In the early 1990s, Shougang was the first Chinese firm to expand into Latin America, with an iron operation in Peru. Its history there since has been marked by hostility from the local community. “Shougang has been rife with environmental tragedy and community relations mistakes,” says Kevin Gallagher, author of The Dragon in the Room: China and the Future of Latin American Industrialisation.

Locals and Peruvian environmental groups have accused Shougang of tipping chemical waste into the sea. In the 1990s, the company was fined US$14 million by the Peruvian government for failing to meet its promises to invest in local infrastructure. In 2005, during one of many protests against the company, Peruvian workers claimed that they were treated like “slaves” by Shougang, working 15-hour shifts for US$13 a day.

Shougang’s torrid experience has raised the stakes for Chinese players, says Cynthia Sanborn. “Chinese companies have had a bad press in Africa and Shougang got a really bad press. Chinalco, as a Chinese company, had a lot to prove.”

In recent years, local opposition has stalled many other potential Chinese mining projects, such as Zijn’s Rio Blanco copper project in northern Peru. The situation has been so severe that Toromocho would be the first operational Chinese mining venture in Peru since Shougang. Much of the burden of repairing the reputation of Chinese firms has fallen on Chinalco.

A template for Chinese companies?

Though it is still too early to say with certainty, observers suggest Chinalco has so far handled the task well. “The process of consultation, the care with which they [Chinalco] have been trying to consult everybody and to be transparent, I think is outstanding for Peru,” says Sanborn. She says that part of Chinalco’s success stems from learning the mistakes of companies like Shougang. “I think each Chinese company has learnt from others. They have an informal group that meets and discusses their experiences.”

One of the key lessons concerns the visibility of Chinese staff. Shougang’s strategy of employing Chinese executives and even workers prompted widespread protest. By contrast, all members of Chinalco Peru’s senior management team, apart from the recently appointed chief executive, are Peruvian. Social Capital Group, in conjunction with the Peruvian representatives of Chinalco, has handled the consultation process, much of the community relations work and the decisions on the future of the new town of Carhuacoto.

“The Chinese have very wisely left their experienced Peruvian team in charge of the process,” says Social Capital’s Matos. “The big decisions like how many houses will be built and how much money will be spent are approved by the Chinese, but we have only ever dealt with the Peruvians.”

The decision to hire managers with local experience also demonstrates a move away from reliance on high-level interaction with central government to ensure mining projects go smoothly. “Other Chinese investors have come to Peru and believed it when presidents and prime ministers have said, “Don’t worry, everything’s going to be ok,” says Sanborn. “But Peru is not a country where the state can work everything out for you.”

This is not to say the project has been trouble free, or that Chinalco lacks critics in Peru. Although more than half of the population of Morococha has already moved to the new town, a significant and vocal group has refused to relocate and has been agitating against the Chinese firm.

In a high-profile bust-up, the mayor of Morococha also abandoned a roundtable he had convened on the subject, claiming all the other representatives of the city were in the pocket of Chinalco. This included Javier Barrera, bishop of Junin and prominent opponent of mining companies with poor environmental records, who had been invited to help mediate the process. Chinalco and Social Capital Group blame the argument on the mayor and demands for more money from Chinalco.

Sanborn believes that the solution will soon be resolved. “I think something will be worked out, Chinalco will come to a compromise and cut a deal with the mayor,” she says. Morococha is a town dependent on mines for its existence, “the protest is not about the mine per se; it’s about getting the best deal out of the company.”

The protests demonstrate the difficulty for any mining company of satisfying the needs and demands of those affected by their projects. Nonetheless, Chinalco stands on the cusp of opening only the second operational, Chinese-run mine in Peruvian history. Its success could yet provide a blueprint for other Chinese companies expanding into Peru.