When the Pudong Development Bank announced its second round of green bonds in March, worth 15 billion yuan (US$2.3 billion), China broke a new record.

China now accounts for almost half of all green bonds issued globally in the first quarter of 2016, only three months after the People’s Bank of China announced its new green lending rules.

The emerging market for green bonds will be followed by the introduction of green financing apparatus, which will create a new source of climate funding for the country.

A study, published by the Research Centre for Climate and Energy Finance at the Central University of Finance and Economics in Beijing, has estimated that China’s need for climate financing will peak in 2020, at 2.6 trillion yuan, or 1.79% of predicted GDP for that year.

To maintain its trajectory, a further 2.5 trillion yuan per year will be required up to 2030, at which point investors will start seeing returns. The report also predicted that demand for private financing will then fall rapidly to 1.5 trillion yuan a year by 2050.

It is hard to predict accurately how much external climate financing will flow into China, so public funds will provide vital leverage. Systemic issues mean there is no short-term solution to the funding gap. To begin with, differing definitions of what makes a “green project” and a lack of transparent corporate data make it difficult to accurately predict the ratio at which public funding will leverage private investment.

Challenges

While traditional financial markets remain the largest potential source of funding, existing policies and sources have made it hard to access on a large-scale.

The profitability of climate adaptation projects is not easy estimate, which creates uncertainty that is unattractive to investors. While clean technology is now used in a wider range of sectors, existing statistical methods still struggle to track funding movements promptly. For some investors, the up-front costs of infrastructure projects are too high, and the investment, too risk.

Green bonds take off

Despite the challenges, since 2015 China has made major progress in green financing. Almost all top-level policy documents have cited green financing as a component of national strategy.

Financial markets are eagerly adopting green bonds. On December 22 2015, the People’s Bank of China published a document on the implementation of green bonds, and less than a month later, on January 27 and 28, the Pudong Development Bank and the Industrial Bank issued green bonds with a joint value of 30 billion yuan (US$4.6 billion).

A robust bond market and strong demand for funding will result on average, in 300 billion yuan (US$ 46 billion) of green bonds being issued every year up to 2020, supporting green industries and supplementing climate financing via the capital markets, say China’s experts.

As of the end of the third quarter of 2016, 53 billion yuan (US$8) in green finance bonds had been issued on China’s inter-bank markets, accounting for around half of the US$16 billion of these bonds in circulation globally.

At the international level, multilateral financial bodies are still raising, managing and allocating the lion’s share of public funding. This has generated a huge demand for mainstream funding products that meet the needs of both investors and project developers.

The role of development banks

Initiatives to cut emissions have been widely embraced, particularly in developing countries. Brazil’s central bank became the first to sign up to the Basel III rules in 2011, requiring the country’s banking sector to take climate risks into consideration when making lending choices. China’s central bank and its regulators have also put similar measures in place.

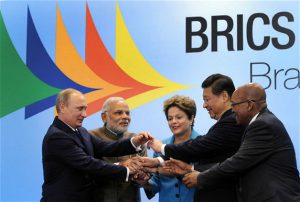

Brazil also set up a cross-departmental green bond commission to promote development of the bonds. India’s Securities and Exchange Board issued a concept paper on green bonds in 2015. With the rapid take off of its green bond market, China has drawn particular attention during this round of green finance implementation.

It is mainly the development-orientated financial bodies that are contributing to the climate field. In 2014, half of climate funding, or US$66.5 billion, came from such multilateral or bilateral institutions, a post-2011 peak. With environmental awareness increasing within and among these emerging institutions, such as the AIIB and the BRICS-founded New Development Bank, further increases are expected after 2016.