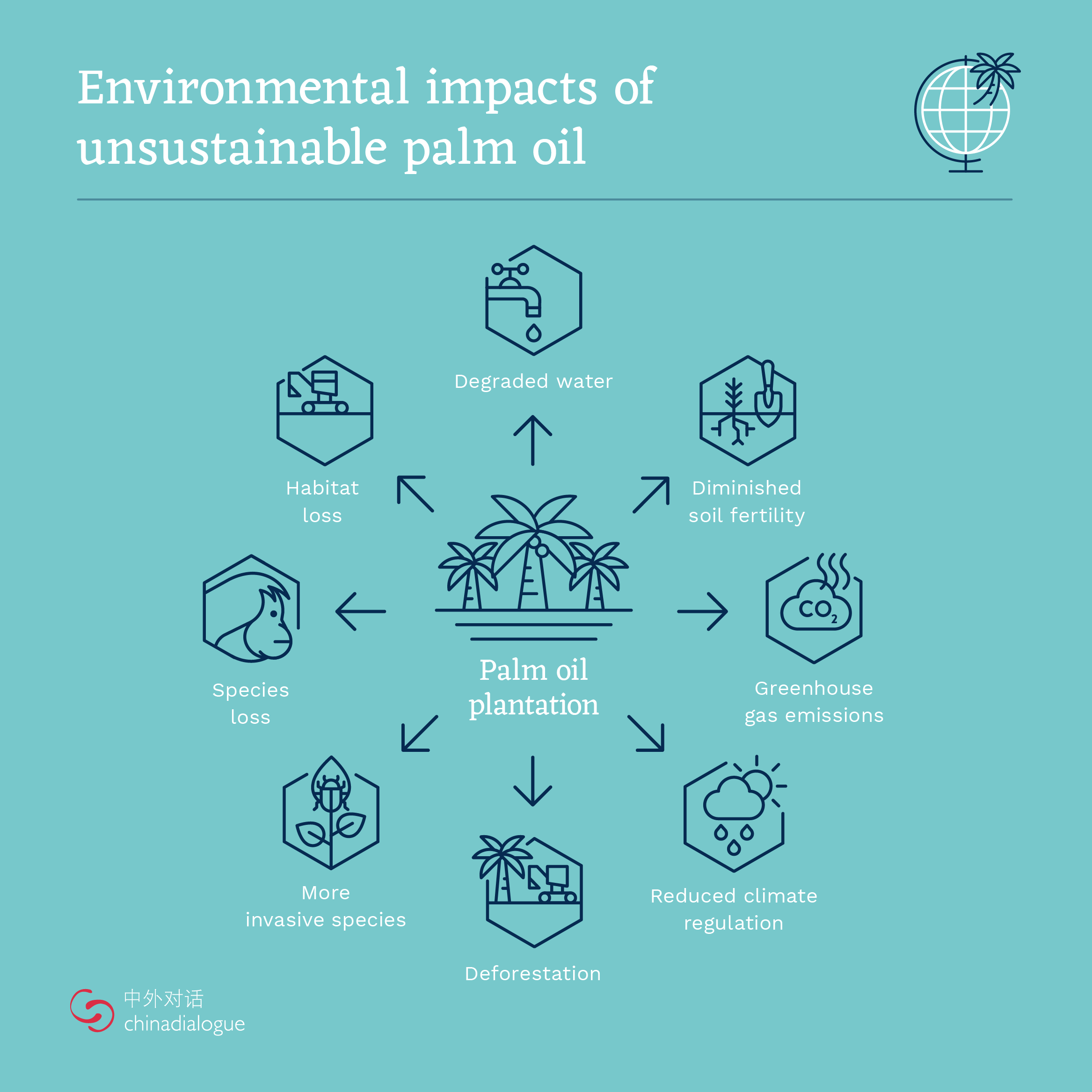

Fires are burning once more in Indonesia, and the finger is again being pointed at the palm oil industry. Used to clear land for plantations, the fires also destroy the habitat of critically endangered species like Sumatran orangutans and rhinos, and emit greenhouse gases.

Over the past decade, campaigns on destructive palm oil production in Indonesia and Malaysia have raised consumer awareness and changed supply chains, at least those connected to western markets. Europe, which has been at the forefront, is looking to ban the use of unsustainable palm oil for biofuels, while several US brands have decided to either eliminate palm oil or use it only when certified as sustainable by the Roundtable on Sustainable Palm Oil (RSPO).

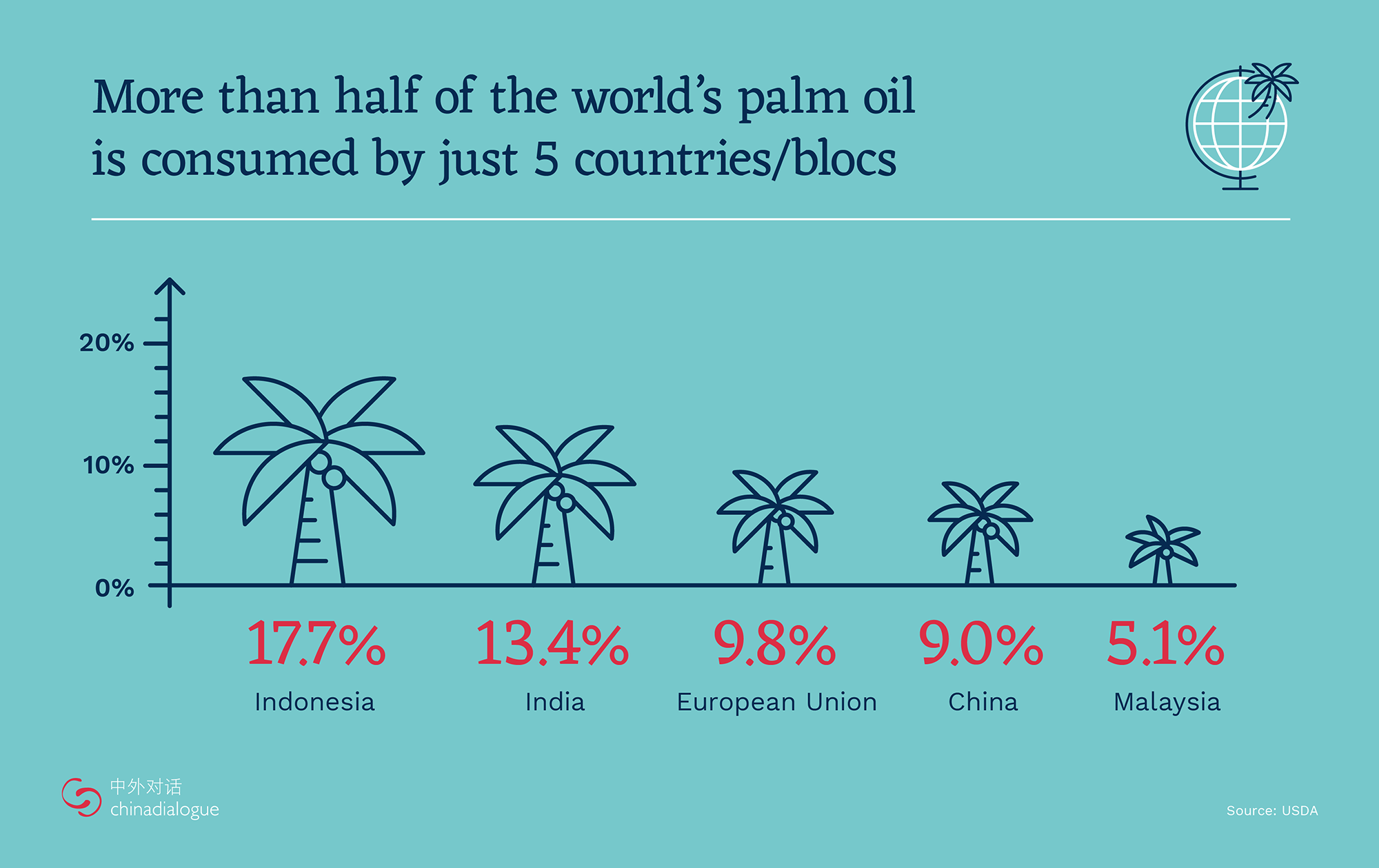

But the positive changes have been more than negated by growth in demand for unsustainable palm oil from other markets. No country plays a larger role than China, the chief destination for Indonesian exports and among the top consumers of palm oil. Imports of palm oil into China have grown more than three-fold since 2000, with the country importing 6.3 million tonnes in 2019. Demand is currently growing by about 10% annually, according to the RSPO.

China’s recent move to reduce import quotas and tariffs on Indonesian palm oil is expected to increase demand further.

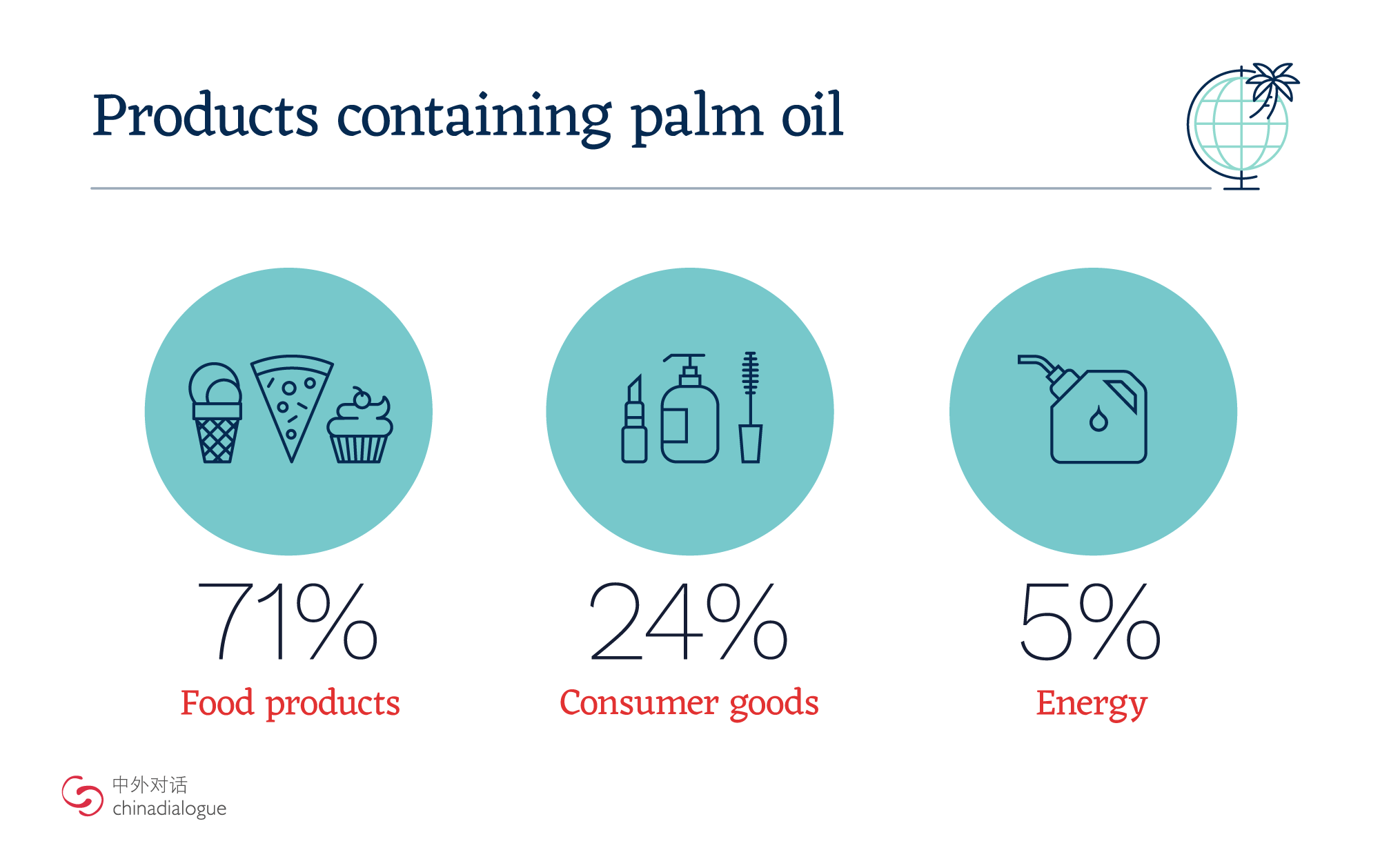

Palm oil is primarily used in packaged foods such as instant noodles, but also in cooking oil, cosmetics and other products. Until recently, nearly none was sourced sustainably.

“China’s attitude towards sustainable palm oil will have a significant impact on the global supply chain,” said Darrel Weber, CEO of RSPO. “We are at the critical point of protecting biodiversity, tackling climate change and deforestation and solving social problems.”

That’s why the RSPO, WWF China, Carbon Disclosure Project (CDP) China, and others, launched the China Sustainable Palm Oil Alliance (CSPOA) last July. Six major brands are now members, including AAK, Cargill China, HSBC, L’Oréal China, Mars and MingFai Group.

“We saw the potential role of palm oil key stakeholders in China to take the lead in making sustainable palm oil a norm,” said Fei Li, CDP China’s Forests Program Manager.

Member brands of CSPOA have committed to sourcing sustainable palm oil and hope their stance encourages other buyers of imported palm oil to implement best practices too. Their initial goal is to make sure that 10% of all palm oil imports are certified as sustainably sourced.

“We and other members made commitments to promote the adoption of sustainable palm oil in the Chinese markets,” said Charlene Lin, sustainable sourcing manager at Mars Wrigley China. “Hopefully as more and more industry players join the CSPOA, there will be more uptake and that will drive an industry transformation.”

At the moment, China is largely dependent on unsustainable palm oil imported from Southeast Asia. Despite its pre-eminent position in the region’s economy, palm oil does not grow naturally there. It arrived as a cash crop during the colonial era, and saw massive expansion from the 1990s due to demand for biofuels in Europe and non-hydrogenated oil in the United States. It is now the world’s most consumed food oil, and Indonesia and Malaysia dominate global output. In Indonesia alone, production grew from 19.2 million tonnes in 2008 to 32 million tons in 2016, with the vast majority exported. China has driven that growth, but other countries including India and Pakistan are also key players.

Shifting from palm oil to another food oil, as some advocate, may not have the intended impact, because palm is far more productive per hectare than any other oil-producing crop. That is why advocates are calling for sustainable farming, following strict guidelines – like those set forth by the RSPO or the Palm Oil Innovation Group – that mandate best practices and prohibit the use of fire to clear primary forest for palm oil production.

One big challenge for CSPOA will be to increase brand and consumer awareness in China, where both the country’s growing dependence on palm oil and its environmental impact in Southeast Asia are largely unknown. Until now, there has been no concerted effort to raise awareness.

“Currently, certified sustainable palm oil is not a mainstream commodity in China,” said Weber. “Greater knowledge and awareness is needed among Chinese consumers and stakeholders about sustainably produced oil palm, to help us achieve our shared vision of making sustainable palm oil the norm.”

On that front, CSPOA has been working with bodies including the China Chain Business Association and the China Sustainable Consumption Roundtable, and plans to increase public outreach. China’s size, and its growing palm oil footprint mean the future of large swathes of tropical forest could depend on whether or not it quickly adopts RSPO-certified palm oil.

“China can leverage its interest and action in sustainable palm oil to effect meaningful change on the ground in some of the most biologically rich countries in the world,” said Zhonghao Jin WWF China’s head of markets practice.

So far, the reaction of Indonesia and Malaysia to Europe’s move to limit imports of unsustainable palm oil is to lobby hard, and push to open up new markets. If China made similar demands and took action to eliminate imports of palm oil connected to deforestation, there would be less space left for uncertified producers.

“This would have a significant and positive impact on the global supply chain,” said Weber. “The transformation of China’s market will be an important milestone for oil palm producers.”

This article is part of our ongoing series on palm oil. Explore the series to date here.